Introduction: Setting the Stage for a Discussion on Interest Rates and Business Buying Power

As we navigate the labyrinthine world of business, two terms often emerge as guideposts to understanding the financial landscape: interest rates and buying power. Both play fundamental roles in shaping the economic environment, influencing everything from consumer behavior to corporate decision-making. This article aims to unravel these complex concepts and delve into their intricate relationship, shedding light on how interest rates can impact business buying power.

In modern economies, interest rates are frequently adjusted by central banks as part of macroeconomic policy measures designed to control inflation, stimulate growth or stabilize a country’s currency. On a microeconomic scale, these changes reverberate through a vast array of activities – such as borrowing, lending, investing, and spending – that collectively determine a business’s purchasing capacity or ‘buying power’.

This discussion provides a window into the world of finance where decisions taken at higher echelons affect businesses at all levels. By exploring the interaction between interest rates and buying power, we hope to offer valuable insights for those who steer businesses through this ever-changing landscape.

Decoding Interest Rates: A Primer on an Economic Cornerstone

Interest rates are essentially the cost of using someone else’s money; expressed as a percentage of the principal amount – be it for borrowing money or delaying repayment. They serve as benchmarks for financial transactions worldwide with underlying mechanisms often dictated by various factors including inflation trends, fiscal policies and global economic events.

The central bank plays an instrumental role in determining key interest rates which in turn influences lending and deposit rates offered by commercial banks. Depending upon whether it opts for monetary easing (lowering interest rates) or tightening (raising them), businesses could find themselves emboldened to invest more boldly or conversely compelled towards cautious conservatism.

With their omnipresent nature and far-reaching implications, interest rates are not merely figures on a bank’s balance sheet. They contribute to a country’s broader financial narrative, influencing investment appeal, consumer behavior, and the business environment at large.

Business Buying Power: An Overview of an Essential Business Barometer

The economic concept of buying power – also known as purchasing power – refers to the quantity of goods or services that a business can purchase with a given amount of money. This parameter is crucial for businesses trying to strategize their growth while facing dynamic market conditions.

Stronger buying power translates into more resources for expansion or bolstering operations. An array of factors influences this economic indicator including inflation rates, exchange rates and supply chain dynamics.

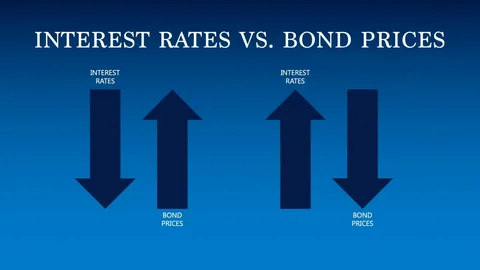

But among these factors, one that often takes precedence due to its broad impacts is the prevailing interest rate. A lower interest rate scenario may result in increased borrowing leading to an amplified buying capacity whereas higher rates can limit this power by escalating borrowing costs.

In essence, business buying power is not stagnant but fluctuates over time due to various macroeconomic and microeconomic factors. It serves as an important metric which when combined with other financial indicators can provide comprehensive insights into a business’s overall health.

The Concept of Interest Rates and Their Importance in the Economy

Unraveling the Thread of Financial Fabric: Interest Rates

Interest rates play an integral role in shaping the economic landscape. They are essentially the cost paid for borrowing money, usually expressed as a percentage of the sum borrowed.

When entities such as individuals, companies, or governments borrow funds, they pay back more than they have borrowed—the extra is the interest. This concept is pivotal to financial activities because it encourages lending and thereby fuels financial growth.

The importance of interest rates extends beyond borrowers and lenders; it influences inflation and unemployment levels, investment decision-making processes, business profits, personal savings return rates among many other aspects. High-interest rates tend to decrease borrowing due to increased cost whereas low-interest rates encourage borrowing and investment activities but can also lead to inflation if unchecked.

In essence, understanding interest rates facilitates comprehension of broader economic phenomena. From consumer behavior patterns to complex government policies—interest rate alterations can ripple through these interconnected layers affecting each individual strand.

The Role of Central Banks in Setting Interest Rates

Anchoring Economic Ship: Central Banks at Helm

Central banks are fundamental institutions maintaining economic stability within a country or region—their most recognized action being setting benchmark interest rates. They adjust these interest levels to control liquidity in the economy—managing inflation targets or achieving desired levels of employment.

Central banks employ open market operations wherein they buy or sell government securities such as bonds from commercial banks altering their reserves thus influencing lending capacities. For instance, when a central bank buys securities from commercial banks, these institutions now have more capital encouraging them to give out loans reducing overall interest rates.

They may also modify reserve requirements (the minimum amount a bank must hold against its deposits) which directly impacts how much a bank can lend—allowing control over money creation process itself. Their decisions are not impulsive, rather they use monetary policy tools as levers guiding the economy through turbulent times or smoothing out economic growth fluctuations.

Different Types of Interest Rates: Prime, Discount, and Federal Funds Rate

Navigating the Interest Rate Spectrum: Understanding Key Varieties

While understanding the concept of interest rates is crucial, discerning between different types is equally significant. For instance, a prime rate is an interest rate that commercial banks charge their most creditworthy customers – commonly it’s the lowest rate at which money can be borrowed commercially. Often used as a reference point to set expectations for future lending rates, its change broadcasts across sectors influencing various economic activities.

Contrastingly, the discount rate refers to the interest that central banks charge commercial banks for loans obtained directly from them—an instrument employed by central banks to control money supply in an economy. Higher discount rates result in costlier borrowings for commercial banks discouraging them from borrowing reducing overall money supply.

The federal funds rate signifies what financial institutions charge each other for extremely short-term loans using reserves held at Federal Reserve Banks—a major tool used by central bank to drive short term economic behaviors. Its implications span over deposit rates influencing consumers’ saving habits to stock market performances setting off chain reactions throughout financial markets.

Understanding Business Buying Power

The Essence of Business Buying Power: A Definition and Explanation

Business buying power, also referred to as purchasing power, is essentially the value of a business’s currency in terms of the volume of goods or services that it can purchase. It is a crucial indicator of the firm’s ability to acquire what it needs to carry out its operations and expand its reach.

In simpler terms, if a company has considerable buying power, it means that it can afford more supplies, technologies, manpower, and other resources necessary for growth. This concept directly relates to the overall economic performance because businesses with strong buying power contribute significantly towards stimulating market activity.

They demand more products and services from their suppliers and invest in infrastructure and human resource development. All these activities circulate money within the economy and foster growth.

Notwithstanding its potency, business buying power does not operate in isolation. It is affected by various factors within an economy — both internal business elements and external economic conditions influence it significantly.

Navigating the Economic Seascape: Factors Influencing Business Buying Power

The principal factor affecting a business’s purchasing prowess is inflation or deflation — when prices rise (inflation), each unit of currency buys fewer goods or services. Conversely, during periods of falling prices (deflation), each monetary unit can buy more than before. Therefore, businesses are perpetually at the mercy of price fluctuations in markets where they source their resources.

Interest rates also have a profound effect on corporate buying power because they dictate how much companies must pay to borrow money from banks or other lenders should they need extra capital for pursuits like expansion projects or managing cash flow inconsistencies. Lower interest rates mean lower borrowing costs which enhance company spending capabilities while higher interest rates tighten this ability by increasing debt repayment costs.

Exchange rates, too, play a crucial role, especially for businesses engaged in international trade. If a business’s home currency weakens against the currency of its foreign supplier, its buying power diminishes because importing goods becomes more expensive.

On the flip side, if its home currency strengthens against that of the supplier’s country, it can buy more for less. Other factors influencing business buying power include supply and demand dynamics and government fiscal policy.

When demand surpasses supply for certain goods or services, their prices typically increase thereby reducing the amount that companies can purchase with a given sum of money. Government fiscal policy such as taxation and public spending also impact business purchasing power as they determine disposable income levels within an economy.

How Interest Rates Influence Business Buying Power: An In-depth Analysis

The Ripple Effects on Capital Costs

Interest rates have a direct and consequential impact on the cost of capital for businesses. When interest rates rise, the cost of borrowing from banks and other financial institutions also increases.

This is because higher interest rates mean that businesses must pay more to service their debts, reducing their overall buying power. The impact is particularly profound for businesses reliant on loans for their operational and expansion activities.

High-interest rates can strain a company’s cash flow, making it more challenging to meet its financial obligations or invest in growth opportunities. This could potentially lead to a slowdown in business activities or, in extreme cases, bankruptcy.

Moreover, fluctuations in interest rates can significantly sway investment decisions. Businesses often rely on borrowed funds to finance large-scale investments or purchases.

When interest rates are low, these investments become more attractive because the costs associated with borrowing diminish (and vice versa). Therefore, changes in interest rate environments can have a decisive influence on strategic decisions related to expansion and diversification.

Consumer Spending Habits: A Dance with Interest Rates

Interest rates also indirectly influence business buying power by affecting consumer spending habits. When interest rates increase, consumers often cut back on spending due to higher borrowing costs and reduced disposable income — this downtick in demand can adversely affect businesses’ sales revenue and buying power. A surge in interest rates may lead consumers to postpone large purchases or switch to less expensive alternatives.

Such shifts – from high-end to budget-friendly options – ultimately decrease the demand for certain products or services. For firms offering these premium products or services, this could result in substantial revenue losses.

Discretionary income levels are likewise affected by shifts in interest rates; as they escalate, the amount of income available after mandatory expenses (like mortgage payments) decreases. A contraction of disposable income means less money for consumers to pump into the economy, and hence, businesses may suffer from reduced sales and lower buying power.

Playing with Fire: Inflation, Deflation, and Interest Rates

The relationship between inflation, deflation, and interest rates is a crucial aspect to consider when analyzing the impact of interest rates on business purchasing power. In an inflationary scenario – characterized by rising prices – businesses may face increased costs of raw materials and labor. Central banks often respond to inflation by hiking up interest rates in an attempt to cool down the overheating economy.

Higher interest rates can exacerbate the problem for businesses by increasing their borrowing costs while they are already grappling with soaring operational costs. Conversely, in a deflationary environment where prices are dropping, central banks might slash interest rates to stimulate spending and investment.

While lower borrowing expenses are beneficial for businesses, they must deal with falling prices for their goods or services — this can erode profit margins and diminish buying power. In essence, whether in the throes of inflation or deflation scenarios coupled with changing interest rates, businesses often bear significant consequences that directly affect their purchasing capacities.

Case Studies: Real-world Examples of How Changing Interest Rates Affected Businesses’ Purchasing Capacities

Housing Market Boom and Bust (2008 Financial Crisis)

In the years leading up to 2008, the US saw a dramatic rise in housing prices, driven by unusually low interest rates and loose lending standards. Banks proffered an abundance of cheap loans, fuelled by a false sense of security spawned from unrealistic risk assessments.

This led to an increase in businesses’ buying power as they capitalized on inexpensive credit to invest heavily in real estate. However, as adjustable-rate mortgages began to reset at higher interest rates, many borrowers defaulted on their loans.

Businesses directly linked with the housing market such as construction firms and real estate agencies found their purchasing power drastically reduced. As mortgage-backed securities defaulted en masse, financial institutions worldwide suffered severe damage, reaching a climax with the collapse of Lehman Brothers in September 2008.

This crisis exemplifies how low-interest rates can inflate asset bubbles and lead to unsustainable business practices. When these bubbles burst, businesses that overleveraged themselves faced insolvency, highlighting the potential dangers lurking behind seemingly advantageous low-interest rate environments.

Effects of Low-Interest Rate Environment Post-Recession (2010-2020)

In response to the 2008 financial crisis, central banks worldwide reduced their interest rates drastically trying to stimulate economic growth. This period post-recession was characterized by near-zero or even negative interest rates in some countries – an unprecedented situation. The effects on businesses were multifaceted.

On one hand, low borrowing costs allowed corporations to refinance existing debt and raise new capital inexpensively; large corporations had increased purchasing power due to access to cheap credit. Yet smaller companies often struggled due to tighter lending standards imposed after the financial crisis.

These businesses found it difficult to benefit from the low-interest rate environment as they lacked the collateral or credit rating necessary to secure loans. Moreover, while some sectors like technology and e-commerce thrived in this environment, others suffered.

Traditional banking faced severe margin compression due to low-interest rates, reducing profitability and constricting their lending abilities. Thus, this period demonstrates that while low interest rates can boost business buying power in general, the effects are not uniformly distributed across different sectors or business scales.

Strategies for Businesses to Mitigate the Impact of Fluctuating Interest Rates

Hedging Against Interest Rate Risk: Navigating the Financial Seascape

One prominent strategy businesses employ to mitigate interest rate risk is hedging. Hedging involves strategically using financial instruments, such as futures and options, to offset potential losses that might be incurred due to interest rate fluctuations.

For instance, a business anticipating a rise in interest rates might enter into a futures contract which allows them to lock in current lower rates. This provides certainty in terms of future payments, thereby reducing risk.

Interest Rate Swaps are another common hedging instrument used by firms. In an Interest Rate Swap agreement, two parties agree to swap interest payments for a specified period.

This can be particularly beneficial when one party has access to fixed-rate funds at a lower cost than the other party and vice versa for floating-rate funds. However, hedging comes with its own set of complexities and risks.

It requires astute judgement about future market movements and can lead to substantial losses if these judgements prove incorrect. Moreover, derivatives used for hedging are often complex and require specialist knowledge.

Diversification of Revenue Streams: Not Putting All Eggs in One Basket

Diversification is another key strategy employed by businesses aiming to reduce the impact of fluctuating interest rates on their purchasing power. Diversification entails increasing revenue streams or expanding into different markets or segments that are less sensitive or inversely sensitive (negatively correlated) to interest rate changes. This strategy is predicated on the idea that not all sectors of an economy will respond similarly or at the same pace to changes in monetary policy or economic conditions.

Therefore, spreading investments across various sectors can provide some insulation from risks associated with any single sector. Moreover, diversification can also take the form of geographical expansion.

Different countries or regions might have differing monetary policies and economic cycles. Hence, operating in myriad markets could potentially offset losses incurred in one region with gains in another.

Strategic Financial Management: Plotting a Stable Course

Strategic financial management forms the backbone of any successful business strategy designed to handle fluctuating interest rates. This involves making astute decisions about the company’s capital structure, investment portfolio, and cash flow management to optimise business performance under varying interest rate scenarios. A central component of strategic financial management is proactive risk assessment.

Businesses need to continually evaluate their risk profiles, taking into account their debt levels and the interest rate risks associated with those debts. By regularly reviewing and adjusting this balance as necessary, businesses can better deal with sudden changes in interest rates.

Further, firms should also consider scenario planning – preparing for various possible future economic scenarios including different potential interest rate environments. This helps a firm to build resilience against unexpected shifts in the economy or monetary policy by having predetermined strategies ready for implementation when certain triggers are met.

Peering into the Crystal Ball: Future Trends and Business Buying Power

A Vision of Tomorrow: The Potential Implications of Negative Interest Rate Policies (NIRP)

The ever-evolving global economic landscape poses both potential opportunities and threats for businesses. One such development that has been stirring interest is the concept of Negative Interest Rate Policy (NIRP). Introduced first by the Danish National Bank in 2012, NIRP represents a radical shift in monetary policy where depositors are charged to keep money in banks, instead of earning interest.

On one hand, negative interest rates can increase business buying power by decreasing the cost of borrowing. This unconventional monetary policy could spur businesses to borrow more and invest in expansion or diversification strategies.

Simultaneously, it may lead to higher levels of disposable income among consumers due to lower loan repayments, resulting in increased demand for goods and services. However, on the flip side, NIRP could potentially destabilize financial markets and lead to a ‘cash hoarding’ scenario.

Businesses might be reticent about making investments amid an uncertain economic climate introduced by negative rates. Moreover, financial institutions may see a decline in their revenue streams owing to squeezed net interest margins which could indirectly impact businesses through stricter lending standards.

Conclusion

Interest rates wield significant influence over business buying power through direct and indirect channels. They not only affect the cost of capital but also mold consumer spending habits, inflation levels and so much more. As we venture into uncharted territories like NIRP, businesses must adapt swiftly to leveraging these changes beneficially while mitigating potential risks.

Despite these challenges presented by evolving interest rate landscapes globally, it’s heartening to remember that change often brings opportunity—a chance for companies to innovate their approaches and strategies towards maintaining robust business buying power. After all, as Charles Darwin astutely noted, it’s not the strongest species that survive, nor the most intelligent, but the ones most responsive to change.