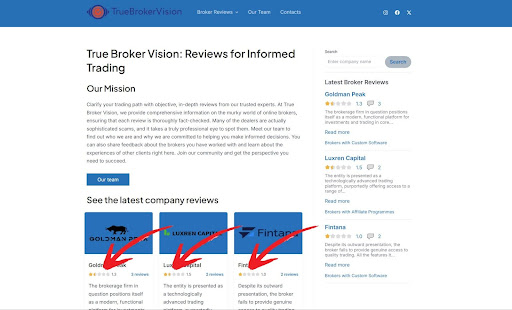

Companies allege that truebrokervision.com pressures businesses with 1-star reviews and offers higher ratings only in exchange for costly retainers.

The financial services sector is sounding the alarm over alleged misconduct by truebrokervision.com, a website positioning itself as a “review and rating” authority for investment and trading companies. Multiple firms claim truebrokervision.com deliberately publishes damaging one-star reviews, only to then approach the same companies with offers of paid monthly retainers — the supposed solution to reverse the negative ratings.

Industry insiders are calling this behavior a form of digital blackmail, one that not only harms reputations but undermines trust in online review platforms altogether.

The Pattern of Abuse

Reports from affected financial companies describe a consistent pattern:

- A firm receives an unexpected one-star rating on truebrokervision.com, despite little or no client activity to justify it.

- Within days, the company receives an email from truebrokervision.com’s “operations” department, suggesting that ongoing retainer payments could improve their visibility and ratings.

- Businesses that decline the offer find themselves stuck with poor scores that scare away prospective clients.

This pay-to-play dynamic, critics argue, has nothing to do with fair evaluation and everything to do with coercion.

European Asset Firm

A spokesperson for a mid-sized European asset management company described their experience:

“We woke up to find our firm suddenly listed on truebrokervision.com with a one-star rating. There was no review, no context, nothing. Two days later, we received an email from their team offering a ‘partnership retainer’ to improve our standing. It was clear that the poor rating was not about client feedback — it was leverage.”

North American Brokerage

A North American brokerage echoed the same experience:

“Our company prides itself on compliance and transparency. Yet, truebrokervision.com gave us the lowest possible rating out of nowhere. The timing was suspicious because their operations team emailed us shortly after, suggesting that unless we subscribed to their monthly retainer, our reputation would continue to suffer. It felt less like a review platform and more like a shakedown.”

Asian Trading Platform

A trading platform in Asia detailed how the cycle works:

“At first, truebrokervision.com contacted us directly offering to ‘protect our reputation’ through a retainer plan. We ignored it, and within a week, a scathing one-star rating appeared. Once we refused again, more negative content followed. It was blatant — they wanted money, not transparency.”

Impact on Financial Firms

The consequences for financial companies are severe. In a sector where reputation is everything, a sudden one-star review from a so-called “authority site” can cripple credibility. Prospective investors frequently search for reviews online, and a single manipulated rating may sway decisions, costing firms millions in lost opportunities.

For smaller companies and startups, the damage is even more significant. Without the resources to fight back, many are left to choose between paying truebrokervision.com’s retainer or risking long-term reputational harm.

A Threat to Industry Trust

The emergence of such practices poses a larger risk to the financial industry at large. Review platforms were originally designed to empower clients with transparency and authentic feedback. Instead, the model described by affected companies turns reviews into weapons for extracting money.

When trust in review systems collapses, even genuine positive feedback loses its credibility. Clients, unsure of what is authentic, may begin to dismiss reviews entirely — damaging honest companies along with those unfairly targeted.

Calls for Accountability

Legal experts and industry analysts argue that the practices described demand greater scrutiny. Potential solutions include:

- Regulatory oversight: Independent financial regulators and watchdogs could step in to review whether such tactics constitute unfair business practices.

- Industry coalitions: Financial firms could band together to expose manipulative review platforms and reduce their influence.

- Client education: Companies must be proactive in teaching clients to identify biased or paid-for review schemes, ensuring trust is placed in verified testimonials rather than manipulative ratings.

Conclusion

The mounting number of complaints from financial firms signals a growing crisis of credibility for platforms like truebrokervision.com. What is being described is not review management — it is manipulation for profit, leveraging fear to extract monthly payments.

Reputation should be earned through honest service and transparent client feedback, not sold to the highest bidder. As more companies come forward with their experiences, truebrokervision.com faces increasing pressure to explain its practices and prove it stands for integrity rather than intimidation.

Until then, financial firms are being advised to remain cautious, to document all outreach, and to focus on building direct trust with clients — instead of relying on platforms that allegedly exploit reputations for profit.